The $85 billion New Markets Tax Credit (NMTC) program represents the largest federal investment in low-income communities over the last 40 years. It is designed to provide last-in gap financing for high-impact, catalytic projects in severely distressed communities that could not proceed without the NMTC subsidy. NMTCs provide 20%- 25% of project costs in very flexible financing that is typically forgiven at the end of a seven-year compliance period. In order to be eligible a project must be located in a Census Tract that has at least 20% poverty, or 80% or less of the area’s median family income. It should be noted that 75% of NMTC's are reserved for Census Tracts with 30% poverty or more or 60% or less of the median family income, and 20% are reserved for rural areas.

The program is administered through private companies called Community Development Entities (CDEs) that compete annually for allocations of authority under the program. In order to be certified as a CDE, an entity must 1) have a stated primary mission of serving low-income communities, 2) be accountable to those communities through at least 20% representation on a Governing or Advisory Board by individuals who are “accountable” to the low-income community through involvement in economic development efforts, operating a business or living in the low-income area. Last year $5 billion in authority was awarded to 100 groups. CDEs are looking for projects with multiple positive community benefits, including 1) economic in terms of job creation, 2) social in terms of education, health and culture, and 3) environmental in terms of remediation of contaminated sites and environmentally friendly buildings.

NMTCs can be used for almost any business, EXCEPT for residential rental housing, which already has the low-income housing tax credit, farms, and a list of “sin” businesses the program does not want to encourage in low-income communities such as race tracks, gambling facilities, massage parlors and liquor stores.

Airports can be eligible for markets tax credits; however, the recipient must be a corporation or partnership, not a governmental entity, which often applies to rural areas. For example, NMTCs helped to fund the expansion of an airport runway in Good News Bay, Alaska, which allowed the airport to accommodate large commercial aircraft to expand a thriving commercial fishing industry.

NMTCs are not directly transferable, however if they are owned by an entity the capital stock of that entity can be transferred, which would also transfer the tax credit benefits.

It depends – ineligible businesses under NMTC regulations are defined as (i) operating a country club, golf course, massage parlor, hot tub facility, suntan facility, racetrack or other gambling facility, or liquor store, (ii) a business that develops, licenses or sells intangibles, or (iii) certain farming businesses with assets over $500,000, due to the fact that there are other federal programs to support farms.

Yes, if they are located in a low-income census tract, which is defined by having at least 20% poverty and less than 80% of the median family income for the area. 75% of NMTCs are reserved for areas of higher distress, with at least 30% poverty, and 60% or less than the median family income.

Yes. Existing businesses can apply for loans for operating purposes to include equipment and working capital, or to purchase real estate to expand facilities if they are located in an eligible low-income Census Tract.

Yes. Office buildings are an eligible project type, if they are located in an eligible low-income Census Tract.

Yes. A single project can have multiple NMTC financings, which are sometimes broken up into tranches to match project phases.

All projects require environmental review as part of the building permit process, but the NMTC program does not impose any environmental impact report requirements.

Cities have been very successful in securing allocations of authority under the New Markets Tax Credit program through their Economic and Industrial Development Authorities, by forming a private entity (typically LLC) to become certified as a Community Development Entity (CDE) and applying for a direct allocation of NMTCs. CBO Financial has assisted municipalities secure NMTCs, including in Louisiana, Tennessee, and Puerto Rico.

The minimum requirement for the NMTC program is that a project is located in a Census Tract with at least 20% poverty and less than 80% of the median family income for the area. 75% of NMTCs are reserved for areas that are “Severely Distressed,” with at least 30% poverty, and 60% or less than the median family income. In the U.S. (and territories) 43% of Census Tracts qualify at the minimum level, and 29% are Severely Distressed.

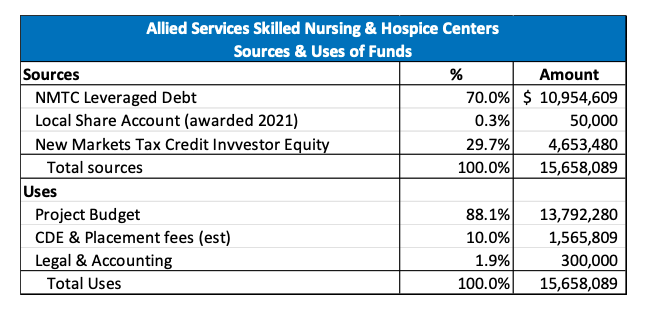

Here is a Sources and Uses of Funds breakdown for a project to renovate a facility to add 42 beds for Medicaid funded assisted living in Wilkes-Barre, PA:

Details re: sources:

Uses:

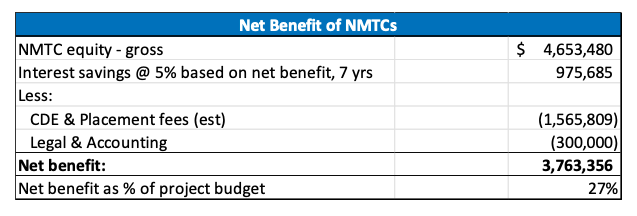

The net benefit of NMTCs for this transaction is estimated as follows:

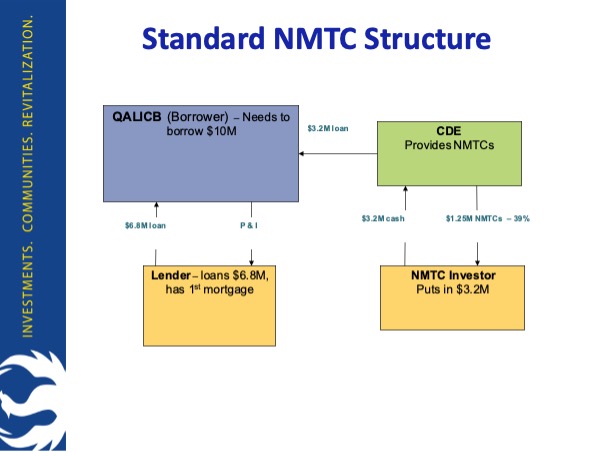

When the NMTC program was originally established by the U.S. Congress it was designed to incentivize investment in low-income communities by providing a 5% interest rate premium of the amount loaned in each of the first three years and then in extra 6% for the next four years during the seven-year compliance period. The thinking was that if investors receive a higher rate of return, they will be willing to take more risk and provide investment to low-income communities which often have difficulty attracting capital. In this scenario the NMTC investor/lender would have capital at risk and would thoroughly underwrite the credit quality of the transaction before making an investment, the NMTC program would simply provide a premium to the interest rate to allow the lender to take risks and make loans they would not otherwise make.

Here is a structure diagram that illustrates the original intent:

The NMTC program is administered by independent companies known as Community Development Entities (CDEs) that compete annually for authority under the program; there is currently $4 billion in unallocated credits on the market, with another $5B to be awarded annually through 2025, after which the program may be extended or become permanent. Eligibility for the program is based on location; the minimum requirement is that the Census Tract where a project is located must have at least a 20% poverty and/or median family income that is 80% or less than area income; however, 75% of NMTCs are typically reserved for “Severely Distressed” areas with higher poverty and lower income (>30% and <60% respectively), and 20% of credits are reserved for “Non-Metro” or rural areas.

There are two ways to secure NMTCs: the first is to form a Community Development Entity (CDE) and apply to the U.S. Treasury Department for an allocation of authority under the program, which is appropriate for groups that have a pipeline of projects. The program is extremely competitive, and the applications are a major undertaking. Groups seeking NMTC subsidy for individual projects can reach out to CDEs that have NMTC allocations and appeal to them for funding.

The process to attract NMTCs from CDEs is as follows:

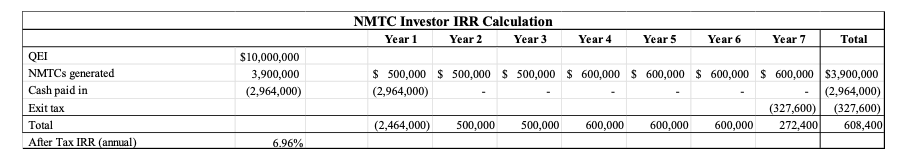

The NMTC program pays an investor 5% of the amount of NMTCs in each of the first three years, and 5% in each of the next four years, for a total of 39%. The investor pays the net present value of this stream of dollar for dollar federal tax reduction, in the current market investors are paying approximately 76 cents per dollar of NMTC value to be received. For example, in a $10M transaction the investor would pay just under $3M for the $3.9M stream of tax credits to be received over the seven-year compliance period. The investor receives 100% of its return of principal and interest in the form of tax credits. Here is a breakdown of the internal rate of return for this sample transaction:

NMTCs can be used for almost any type of project except for “sin” businesses the program does not want to encourage in low-income communities such as race tracks, gambling facilities, massage parlors and liquor stores. NMTCs are meant to provide last-in “gap” financing for projects that will help to revitalize low-income communities but cannot secure sufficient capital from conventional sources to proceed.

While NMTCs technically can be used for infrastructure projects it is not common, in part due to the fact that the NMTC borrower must be a partnership or a corporation, municipalities are not eligible recipients.

Eligibility for NMTCs is based on the poverty level of the Census Tract in which the project is located. The Census Tract must have at least 20% poverty, or 80% or less of the area’s median family income; it should be noted that 75% of NMTC's are reserved for Census Tracts with 30% poverty or more or 60% or less of the median family income, and 20% are reserved for rural areas.

Here are two online mapping tools that will allow you to enter an address to determine poverty levels and NMTC eligibility:

The $75 billion NMTC New Markets Tax Credit program is intended to spur investment in low-income communities that would not otherwise occur, by providing up to 25% of project costs in very flexible financing, which is typically forgiven at the end of a seven-year compliance period. The program is administered by independent companies known as Community Development Entities (CDEs) that compete annually for authority under the program; there is currently $4 billion in unallocated credits on the market, with another $5B to be awarded annually through 2025, at which point the program may be extended or go permanent. Eligibility for the program is based on location; the minimum requirement is that the Census Tract where a project is located must have at least a 20% poverty and/or median family income that is 80% or less than area income; however, 75% of NMTCs are typically reserved for “Severely Distressed” areas with higher poverty and lower income (>30% and <60% respectively), and 20% of credits are reserved for “Non-Metro” or rural areas.

A project is eligible if it is located in an eligible Census Tract with a minimum 20% poverty rate or 80% or less of the area’s median family income, or if it serves or employs a majority low-income persons, and can document it on an ongoing basis.

The NMTC Equity Investor claims 5% of the NMTCs on their annual federal tax return for the first three years, and 6% in each of the next four years of the seven-year compliance period.

There is a put/call agreement between the borrower and NMTC investor whereby at the end of the seven-year compliance period the investor can “put,” or transfer ownership of the Investment Fund to the borrower, which then allows the NMTC portion of the loan to be forgiven.

In the NMTC structure a CDE makes a series of loans to the borrower; these loans are called Qualified Low-income Community Investments, or QLICIs.

The NMTC program is currently authorized to issue $5 billion in new allocation annually through 2025, at which time it may be extended or go permanent.

CDEs accept applications year-round, for groups with a pipeline of projects that wish to apply directly to the US Treasury Department there is an annual application round, with roughly 60 days from release of a Notice of Allocation Availability to when applications must be submitted online.

NMTC Equity Investors are typically banks or other financial institutions. Individuals cannot get the full value of NMTCs due to not being exempt from the Alternative Minimum Tax.

The program is currently authorized through 2025, at which time it should be extended or may go permanent.

** CS additions

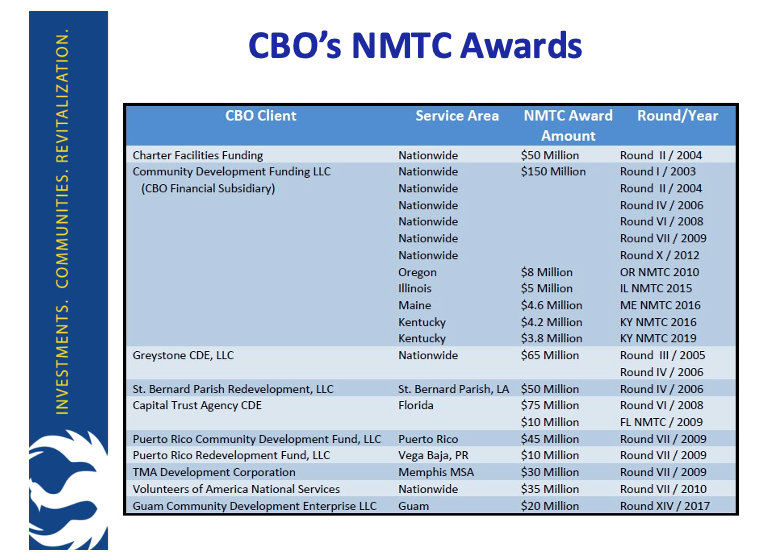

The U.S. Treasury Department has awarded CBO Financials’ subsidiary, Community Development Funding, LLC, with $150M in authority under the NMTC program in six separate awards, one of only a few dozen organizations in the country to have received six or more awards, including awards in the first (2003) and second rounds, meaning the CBO team has been deeply involved since the program’s inception. In addition, CBO has taken a leadership role in securing 18 additional direct NMTC allocations for clients totaling $405M and has placed $250M in transactions with CDEs for clients. CBO can serve as an access point to these programs, in part by developing and marketing a comprehensive Financing Request Package that highlights the positive economic, social and environmental impacts of the project being financed.

In order to be eligible to apply for a direct allocation of NMTCs, an applicant must be certified as a “Community Development Entity” (CDE).

Yes, NMTCs can be combined with a wide variety of government funding programs, with the exception of the federal Low-income Housing Tax Credit program. For example, NMTCs can be combined with:

Yes, some states have enacted NMTC programs to enhance the impact of federal NMTCs. The following states have enacted programs:

As part of the application process CDEs present their mission and service area, and a identify potential investments to serve as examples of the types of projects that they will fund if an allocation is awarded. For the most part CDEs are looking for:

The first step is to determine if your project is NMTC eligible by going to a mapping tool like this one: https://www.cohnreznick.com/nmtc-map

In order to be eligible to apply for NMTCs a company must first become certified as a Community Development Entity. There are two primary requirements to becoming a certified CDE:

Organizations certified as a CDFI by the CDFI Fund or designated as a Specialized Small Business Investment Company (SSBIC) by the Small Business Administration automatically qualify as CDEs. CDE certification applications are accepted on a rolling basis.

The NMTC Allocation Application has five main sections:

Applicants are also required to complete the Application Registration, Applicant Information, and Assurances/Certification sections.